Start Gathering these Documents if you plan to file for the 2025 Philippine Estate Tax Amnesty

Summary: Lessons from 2023 Filing that might help in the 2025 Extension (Post #7)

When my mom passed away, my brother and I were trying to finish all the tax amnesty requirements. Then my brother suddenly died in the Philippines just before the worldwide quarantine. In spite of the travel restrictions, I pursued to finish them from the USA. In the end, I had to travel back to the Philippines and finished it before the end of 2022.

Lessons I Learned during the Last Extension

I learned a lot when I filed for Philippine Estate Tax Amnesty during its 2023 extension. If you will ask me for ONE advice about it, I’ll tell you: start early. It takes a lot of time to prepare supporting documents especially when there are many family members involved! In my case, I am the sole heir yet it took me years and four different representatives in the Philippines to move it forward. Later, I have to go there in person to solve issues on-the-go. It is really better to start gathering your paperwork NOW to meet the deadline. First, review my previous posts:

Getting PSA Certificates and Apostille Documents for Filipinos Abroad

What to do when Names in Realty Tax & LRA Title are Different

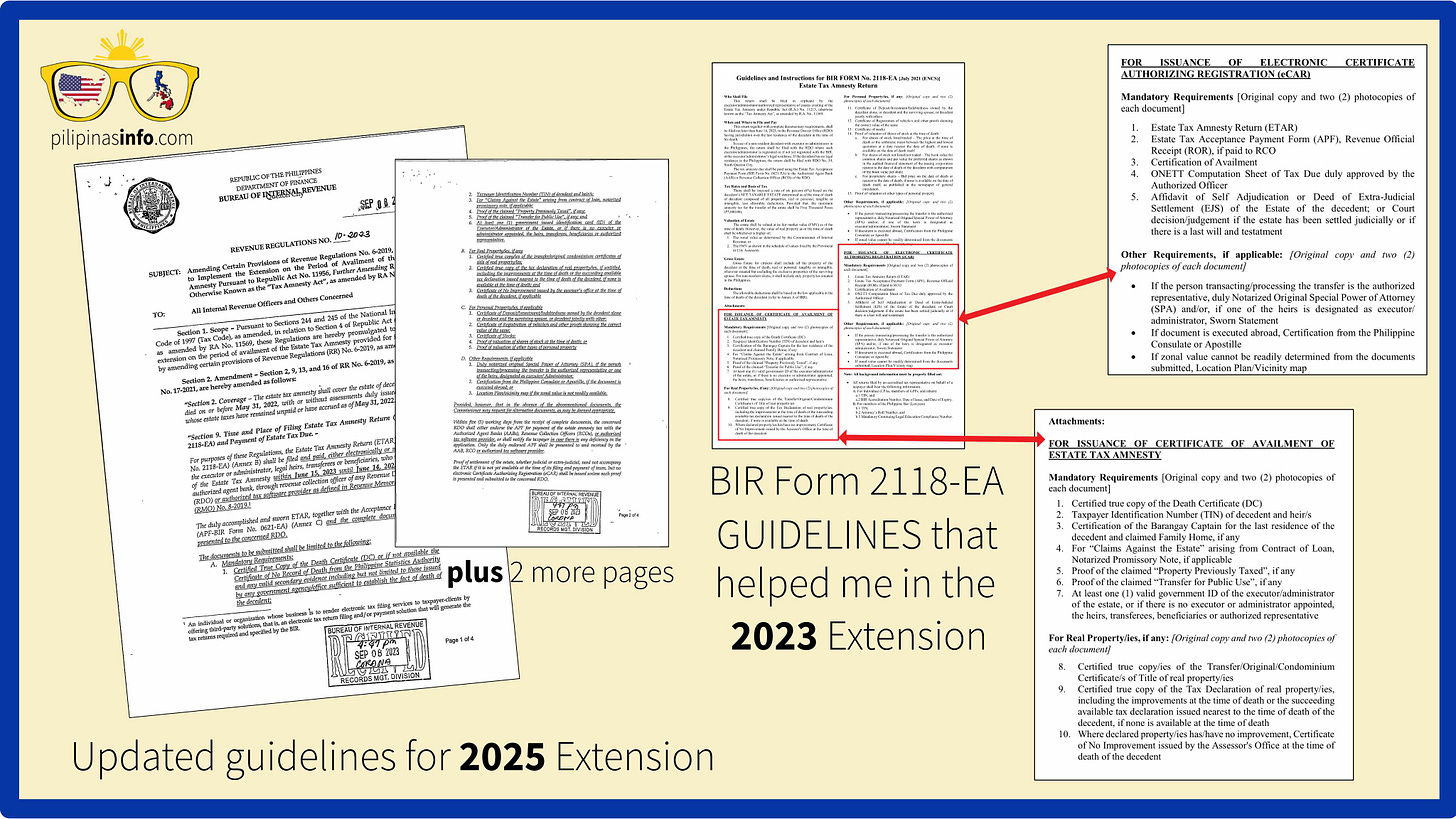

BIR Guidelines

The Bureau of Internal Revenue (BIR) of the Philippines processes the estate tax amnesty. Once it is finished, you an eCAR or Electronic Certificate Authorizing Registration will be issued to you. This eCAR is one of the requirements by the Land Registration Authority (LRA) to transfer the land title to a new owner. BIR has a list of requirements to get an eCAR through the Estate Tax Amnesty Program. The latest list is RR No. 10-2023 which is one of the regulations BIR published on this page. Below is the current BIR guidelines with the guidelines I used in the previous extension.

I know, it looks complicated. What I did is to start with one part first. See the 2118-EA form above? It was easier to focus on the mandatory requirements first then work on the rest. Remember, this was their form during the last extension. Look at the 2025 guidelines or ask your representative to go to your local BIR office to get their latest list of requirements. I am just sharing the list I used so you can get started. One more thing, the first requirement is a TIN for your relative who passed away. TIN for the person who died is different from their TIN when they were alive. Also, the local tax assessment value should be what it is during the time of death. I went back and forth the Municipal Assessor’s office because I missed this specific detail.

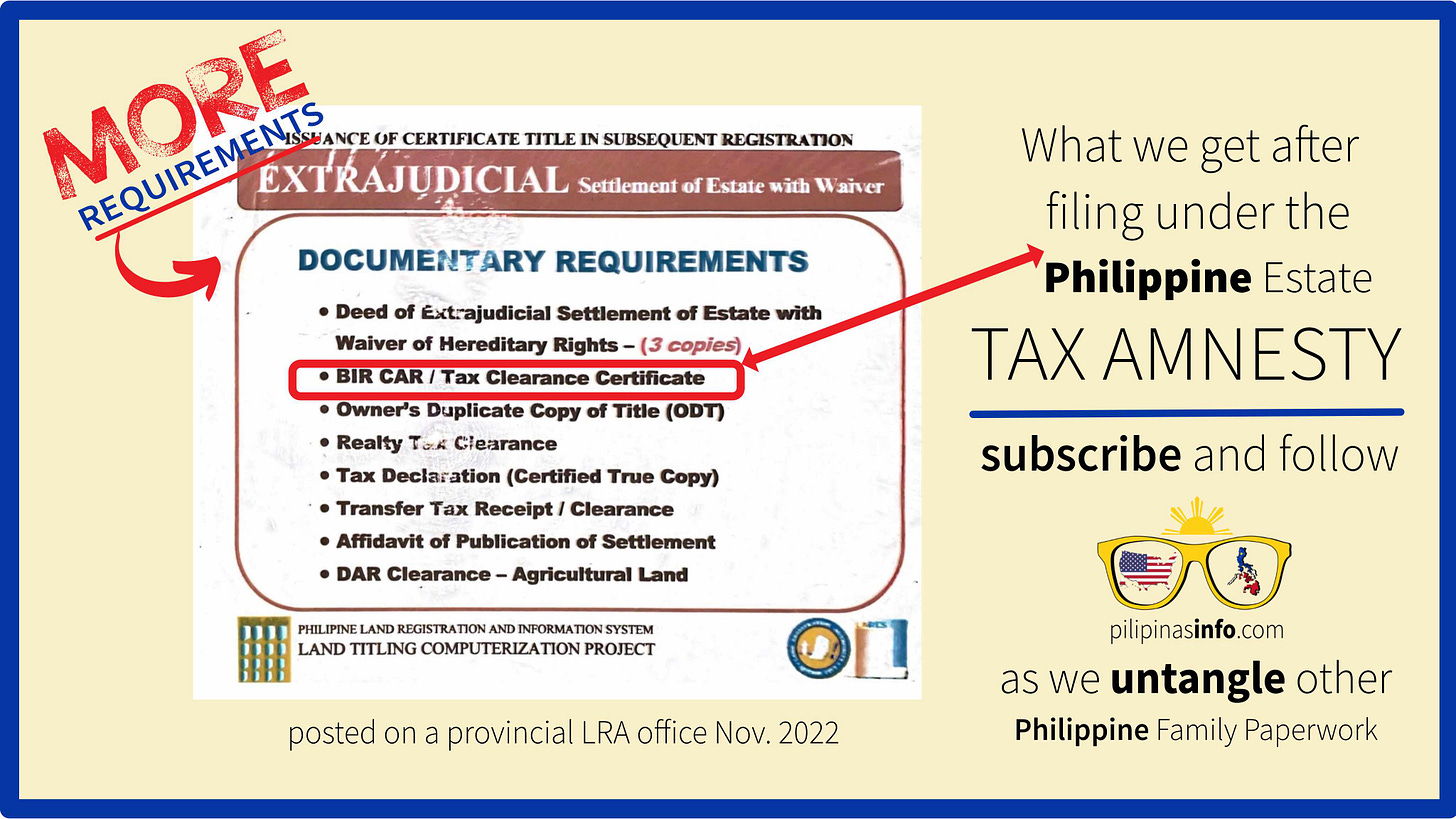

Just One of Many Requirements for Title Transfer

Once you finish filing and paying the discounted estate tax for your late loved ones, you might think the paperwork is finally finished. I hate to break it to you but there are more paperwork involved. Below is a list of requirements to have a “subsequent registration” which I interpret as title transfer.

Subscribe for free so you’ll be updated as I untangle with you my family paperwork in the Philippines. In the meantime, the next series will be about money matters.

Disclaimer: All my posts are for informational purposes only.

Find out more about Pilipinas Info and why you should read and subscribe here.