Philippine Estate Tax Extended to June 2025

Lessons I learned from 2023 extension that may help you

Why is the Philippine Estate Tax Amnesty a big deal? Well, for one, it will save you money and other penalties. In this series, I will share what I learned when I was able to file estate tax for my late mother’s properties before the end of the June 2023 extension. Let’s start wit the basics first.

Dates to Remember

The first Philippine estate tax amnesty was extended up to June 14, 2023. One reason was the travel restrictions during the pandemic. At the end of May 2023, lawmakers passed Republic Act (RA) No. 11956 that extends the amnesty for another two years. It was then submitted to the President for signature. Unsigned, it lapsed into law on August 5. As Business World wrote on 8/9/2023: “An approved bill becomes a law if the President does not act on it 30 days after it is submitted to Malacañang.” Implementing rules will be released after 30 days. While we are waiting its publication, remember:

Estate Tax Amnesty can be availed up to June 14, 2025

Applicable to decedents who died on or before May 31, 2022

You can read the 4-page PDF version of the Republic Act in the Official Gazette here.

Why is it Important

When a family member dies, the last thing on your mind are paperwork deadlines. At least that was true for me. I know my mother had some properties in the Philippines but I did not ask people about paperwork deadline. Later, I found out the consequences of not dealing with it immediately: tax penalties. The computation of the penalty depends on the amount, date of death and other circumstances - you have to ask an accountant or lawyer for details. Moreover, you will not be able to transfer land titles until you pay estate tax.

Land Title Transfer through Inheritance

So how do you change the name of the land you inherited from your parents to yours and your siblings? Well, it is not as simple as telling them you are the heir. You have to prove it and submit numerous paperwork to different Philippine government agencies. Let’s start with the Land Registration Authority (LRA) which overseas land registration.

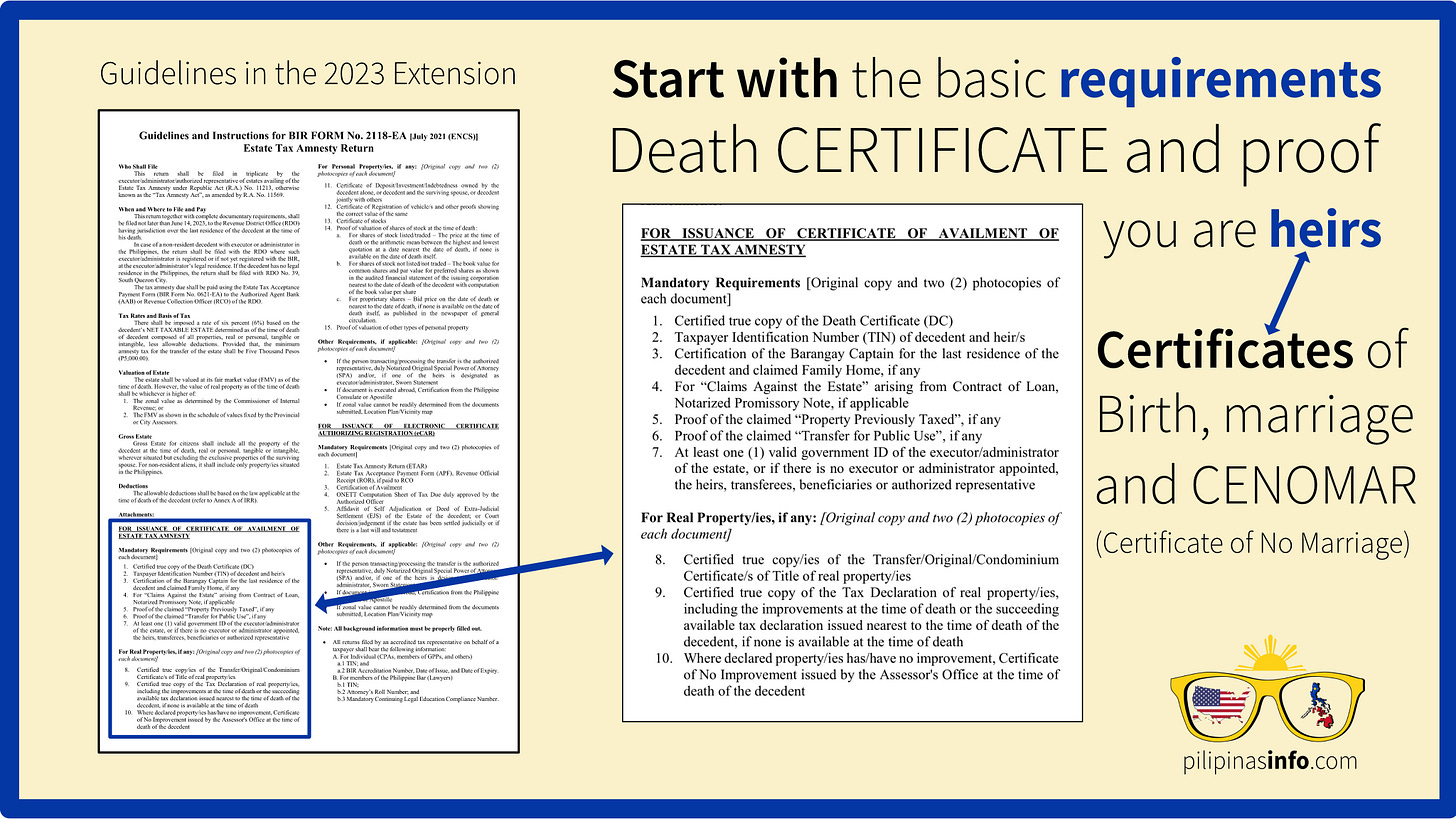

Like you, my instinct was to Google how to transfer land titles. Do it but go to official sources too. The most useful instruction I got from the LRA site was in their FAQ page and I showed the screenshots above. However, the best instruction I found was a post on a bulletin board in a provincial LRA office which I posted above. As you’ll see, they need MANY documents, but I do not want to overwhelm you. Let’s start with the BIR CAR which I highlighted with blue boxex. The Bureau of Internal Revenue (BIR) CAR (Certificate Authorizing Registration) is given after you pay estate taxes. This is why you need to take advantage the Estate Tax Amnesty on or before June 14, 2025. You’ll save a bunch of money based on my experience. I cannot say how much because it depends on what you are inheriting and the dates of all relatives important in your family tree. I’ll explain these in future posts so don’t forget to subscribe for free.

Start with these certificates

What are the requirements to file for estate tax amnesty? Well, the BIR has not published a list as of this writing but go to this BIR webpage to see it as soon as they publish it. You see find below what they required during the 2023 extension. While waiting for the requirements, start with the basics: death and birth certificates.

In a later post, I will discuss how I got all the death, birth and marriage certificates I needed even though I was not in the Philippines. I will also share how I got a death certificate from California that included my dad’s birth name even though he changed his name when he became an American citizen. Subscribe for free so you’ll not miss any post.

Disclaimer: All my posts are for informational purposes only.

Find out more about Pilipinas Info and why you should read and subscribe here.