Begin with Your Family Tree and Land Titles

Philippine Estate Tax Amnesty Series (Post #2)

My second cousins, who are in the Philippines, asked for my birth certificate in addition to the death certificate of my mom. It was supposedly needed to transfer a mother land title to our names during the 2023 Estate Tax Amnesty extension. They were wrong based on our family tree and land title. In this post, I will share with you what I learned and how you can apply it to your own situation for the 2025 extension.

Start with the basics

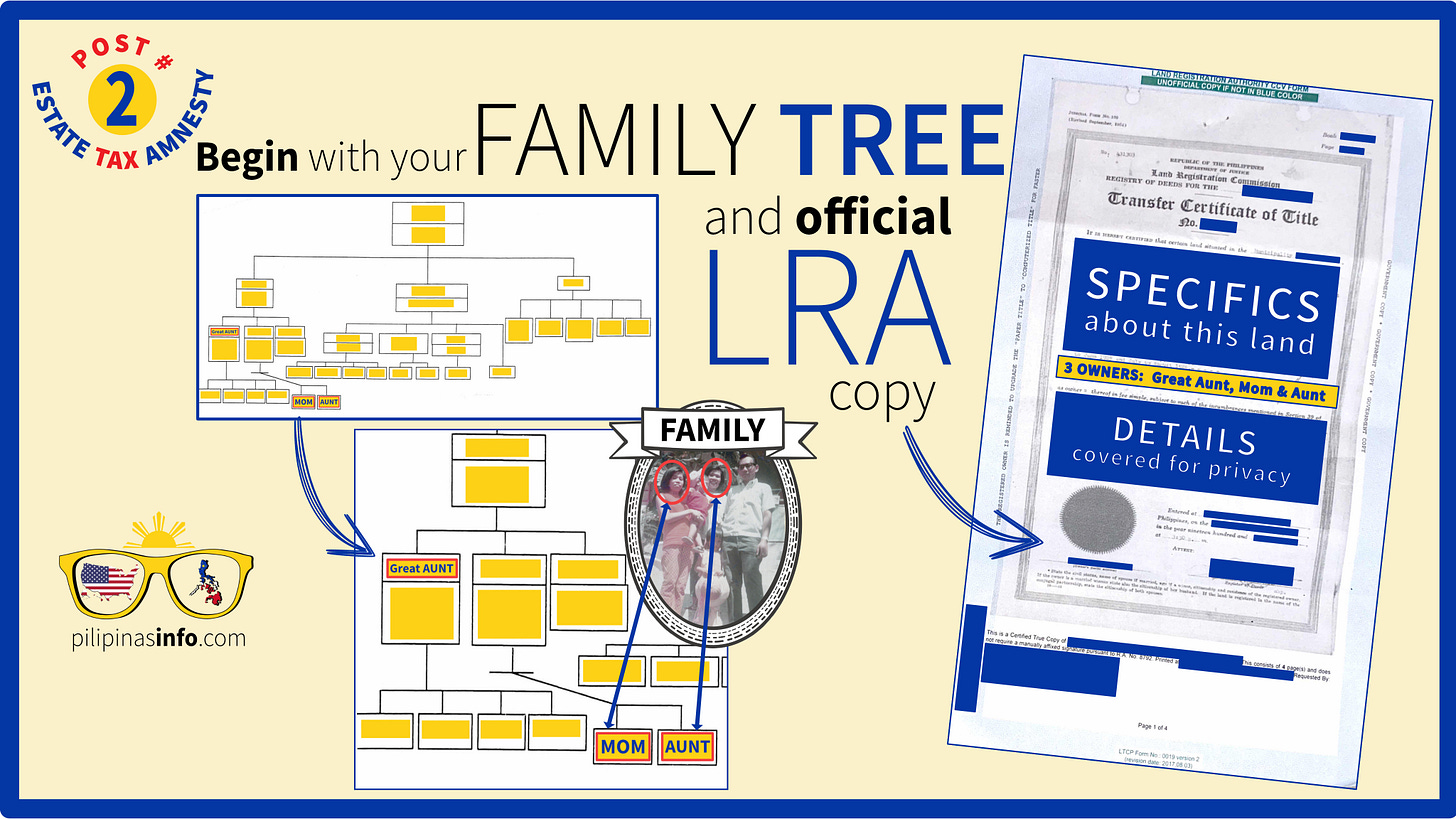

How do you prepare your documents for the Philippine Estate Tax Amnesty? Start with your family tree and latest Land Registration Authority (LRA) copy of your inheritance. But first, read why it is a big deal in this post where I also recommended that you begin to gather all the birth, marriage and death certificates required. In this post, we will zero in on whose certificates do you need by using my family tree as an example.

Lesson #1 - Estate Tax Amnesty is for each Person who Died

My second cousins based their request on a supposedly shared inheritance which were under the names of three deceased owners: my great aunt (their grandmother), my mother and my aunt. They were looking at the land title but the Bureau of Internal Revenue (BIR) is processing the tax amnesty per person based on all the taxable properties under their names. Let’s zoom in.

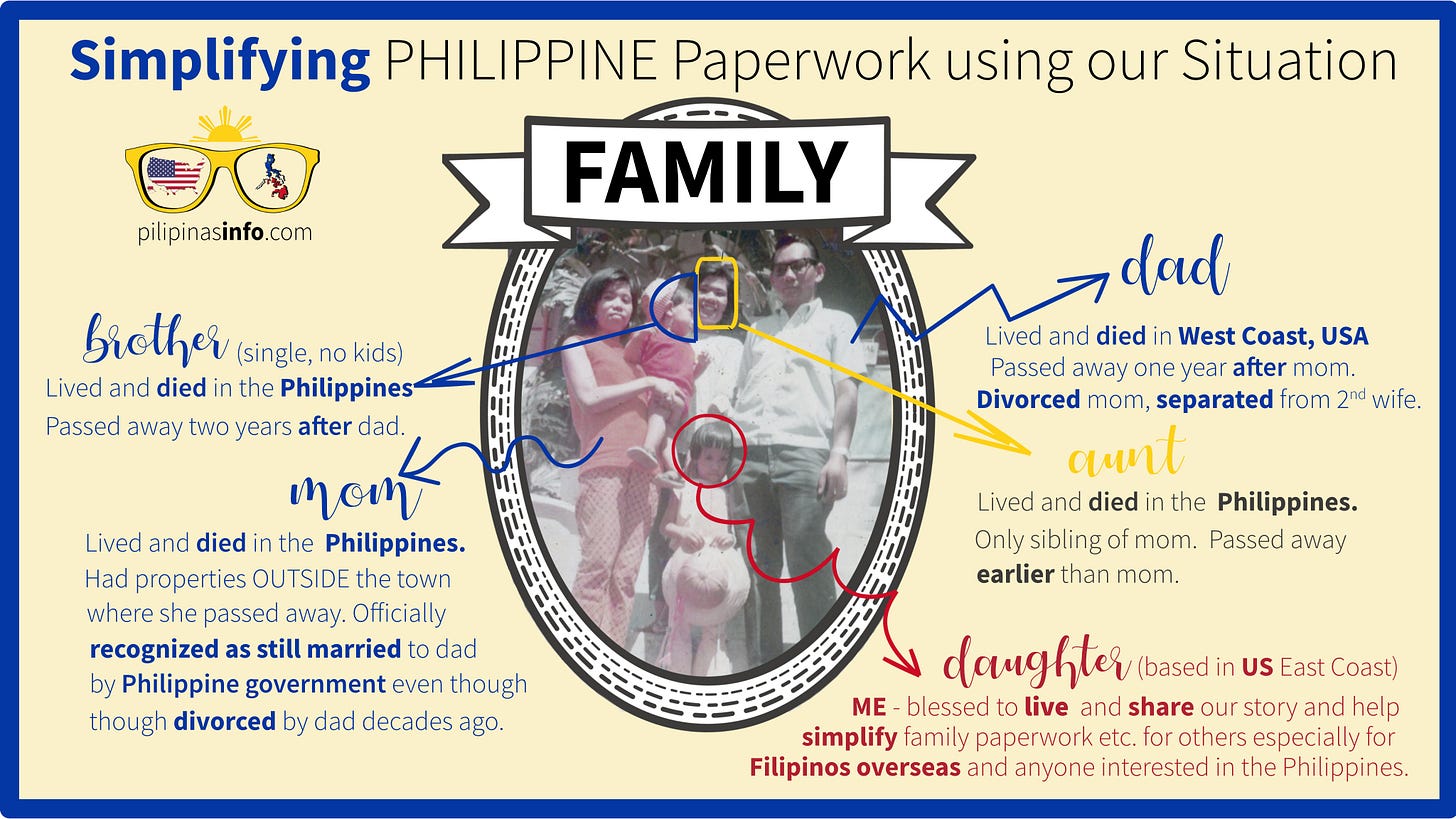

My cousins’ inheritance came from their grandmother (see picture above). Based on our family tree (covered for privacy), there are more people to be considered before they get their share. My inheritance came from my mother. Below is a brief pictorial description of my core family. I am her sole heir. When I processed the estate tax for the same land that my cousins are interested in, BIR processed it together with my mother’s other properties. They did not ask for the tax of my aunt or my great aunt because my inheritance comes from my mother only. BIR only considered the property my mother owned and did not include the property of her co-owners.

Lesson #2 - You Pay for Everyone Who Died

See my complicated family situation above? My mother lived and died in the Philippines while my dad, was based in the USA. Even though my dad died without setting foot in the Philippines for decades, he was included in the estate tax statements. Here are the important points:

BIR asked for my immediate family tree and all the birth, marriage, certificate of no marriage and death certificates.

My parents were considered still married in the Philippines even though a divorce was granted in the USA

My mother died before my dad and brother so computations were made considering their inheritance before I got mine

I have to get a certificate of no marriage and include in my affidavit that my brother had no children

Now look at the family tree of my second cousins where only their parents were included. Some of them have numerous children not included in the illustration. Based on my BIR experience, they have to collect certificates for all of them and pay the taxes for everyone who died.

Lesson #3 - Date of Death and Tax Amount

My aunt’s heirs will have a different experience from me. Remember, my mom, who owned the property we were discussing, died before my dad. My aunt’s husband went before her. Thus, if my first cousins will file for tax amnesty, they will not pay for my uncle’s portion because he passed away before my aunt. The date of death and family identity determines the inheritance flow and amount of tax you pay. I had to pay for the estate tax of both my parents and brother. Ask a lawyer knowledgeable in Philippine Inheritance Law to figure out inheritance percentages. If you have time, scan the Civil Code of the Philippines as published by the Official Gazette here.

Lesson # 4 - Get an LRA Copy

BIR did not accept the original title of one of my mother’s properties. I was surprised. Later, I realized why. The LRA or Land Registration Authority copy trumps all other copies. It is printed on special paper and has the date of request and who requested it. It also has all the additional information needed to find out the current state of the property. It informs you if your copy is still valid or if the property was officially sold to another person. So now what? How will all of these help you? Let’s zoom out.

If you want to take advantage of the 2025 Estate Tax Amnesty, what should you do to prepare? Don’t just ask for birth and death certificates of everyone like my cousins. Do these instead:

get the latest LRA copy of the land you inherited

find the names in the title

write all the names of the relatives involved

get PSA birth and death certificates

get marriage certificates of all female heirs (proof of married name)

get CENOMAR for unmarried heirs

Apostille certificates for those who died abroad

I will write how I got all these certificates while abroad including how I handled my dad’s name change—my birth certificate states his Filipino name while he used a different name when he died. Subscribe for free so you’ll not miss the post in this series especially when you are preparing your documents for the 2025 Philippine Estate Tax Amnesty filing.

Disclaimer: All my posts are for informational purposes only.

Find out more about Pilipinas Info and why you should read and subscribe here.

Good info sheila