What to do when Names in Realty Tax & LRA Title are Different

How our Family Tree Helped in the Philippine Estate Tax Amnesty Filing (Post #6)

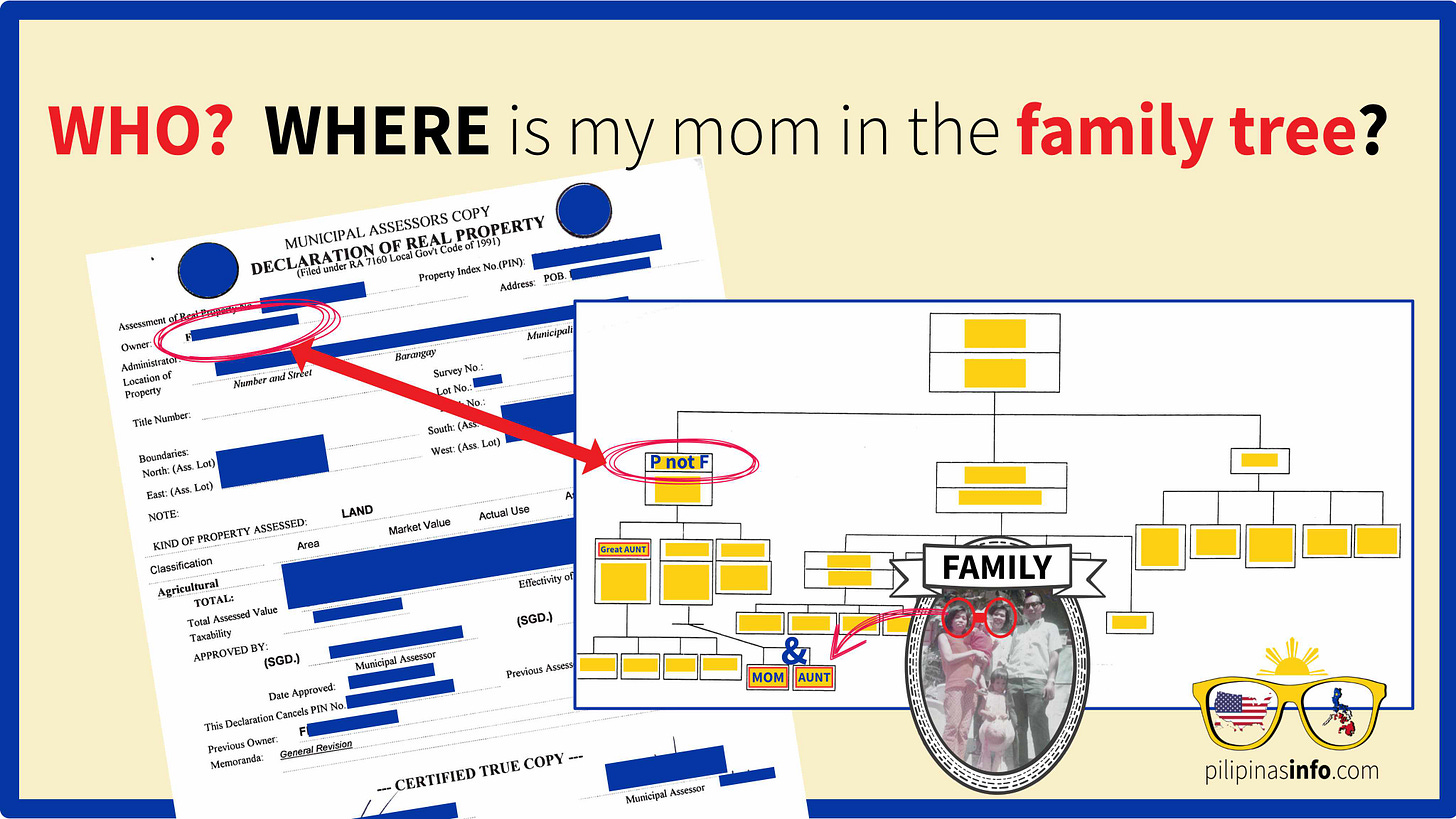

The Bureau of Internal Revenue (BIR) of the Philippines did not allow me to include one of my late mother’s property in the Estate Tax Assessment. At first, I did not understand why. Her name was in the land title and official Land Registration Authority (LRA) copy. Later, my representative in the Philippines told me that BOTH the Realty Tax (Amilyar) and the LRA copy should be in her name. Not in the receipt as a tax payee. Her name should be in the “owner” section. Unfortunately, it was not. In this post, I will share how I was able to solve this issue and include this property when I filed for the Philippine Estate Tax Amnesty.

In a previous post, I wrote about a property that my mom co-owned with two other relatives, my aunt and a great-aunt. Upon further inspection, the municipal assessor’s office records showed that it was owned by an ancestor who I barely knew. BIR gave me the option to file for Estate Amnesty without this property. I declined. Instead, I asked my representative to find out what we can do to update the owner’s name for this land. The assessor’s office complied and gave us a long list of requirements. The picture above is just half of the requirement list.

Record Keeping and Family Tree

My family in the Philippines love to keep mementoes, records and albums. It was a bitter-sweet experience for me to go back there to sort their personal properties when they died. For instance, I did not know that my late brother kept family trees of both sides of our family. That family tree helped.

I saw a name in our maternal family tree that was similar to the amilyar owner’s name. However, that name began with a P while it was an F in the tax assessment. I kept digging and saw that “owner F” is my great grandmother and there were documents that supported the transfer of title to my mom, aunt and great aunt way back in the 60s. I also found paperwork that proved that “owner F’s” real name begins with P, not F. Armed with these documents, I went to the Municipal Assessor’s office to request the change. They, in turn, requested more documents including a notarized sworn narrative about it. I wrote the narrative, notarized it and was there the next day to submit it.

SPA? Here’s my birth certificate.

Before the Municipal Office changed the owner’s name, they still had one more requirement: they asked if I have a Special Power of Attorney (SPA). Well, I told them I am the heir. I am there in person. Actually, I had 3 representatives since I started doing all the inheritance paperwork. Afterwards, I had to go to the Philippines in person. All of them had SPA’s that were certified here in the USA via Apostille. When the municipal assessor asked if I have an SPA, I wanted to give her a lecture about SPAs but I held myself and just showed my birth and marriage certificates. The municipal office obliged and changed the owner’s name to the three co-owners. Finally, the tax assessment and LRA copy have matching owners’ names and I was able to include this property in the Tax Amnesty filing.

It is really important to gather all documents in advance when filing for the Philippine Estate Tax Amnesty that has been extended to June 2025. As I showed you in this post:

find out if your LRA copy and Tax Assessment have matching owner’s names

if they do not match, find who is the owner and locate the person in your family tree

gather all documents that may support the owner name change

send SPA that underwent the Apostille process if you are based in the USA and other countries that use it

always bring PSA copies of your birth and/or marriage certifies - it makes everything faster

Lastly, I brought a copy of our family tree in the Municipal Assessor’s office. It was easier to explain how I was related to the owner. I will summarize and end this series in my next post. Subscribe for free so you’ll not miss it. The next series will be announced on this page.